Understanding Online Cigarette Purchasing

Buying cigarettes online has become increasingly popular for various reasons. One of the main benefits is convenience; consumers can order their favorite brands from the comfort of their home without the hassle of traveling to a store. Additionally, online retailers often have a wider selection than local shops, making it easier to find specific or hard-to-get brands. However, consumers often express concerns regarding the legitimacy of vendors and the legality of their purchases in different regions.When considering online cigarette purchases, it’s essential to understand the legal landscape.

In some jurisdictions, buying cigarettes online is perfectly legal, while in others, it may be restricted or subject to specific regulations. Therefore, knowing the laws in your area can prevent potential legal troubles.

Recognizing Legitimate Vendors

Identifying reputable online cigarette retailers is crucial for a safe purchasing experience. Legitimate vendors typically have several characteristics in common. They provide clear contact information, have a professional website, and display customer service options prominently. To verify the authenticity of cigarette brands sold online, consumers should:

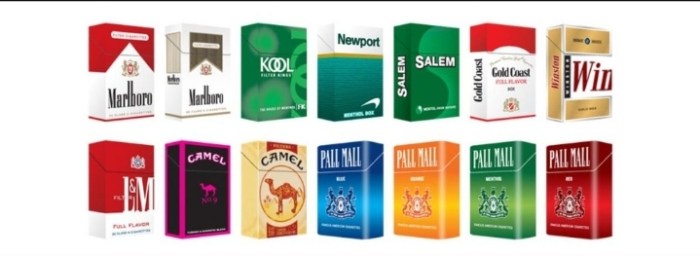

- Check for proper labeling and packaging that meets regulatory standards.

- Look for reviews and testimonials from previous customers to assess the seller’s reputation.

- Ensure the vendor has a secure payment gateway, which is an indicator of a trustworthy site.

Here are some trusted websites known for selling cigarettes safely:

- CigarettesForLess.com

- TobaccoOnline.com

- MySmokingRetailer.com

Identifying Red Flags for Scams

Recognizing warning signs of potential online cigarette scams can save consumers from losing money. Some red flags include:

- Prices that are significantly lower than average market rates.

- Lack of customer service contact options or unclear return policies.

- Websites that are not secured (look for “https” in the URL).

Common types of scams in online cigarette purchases include fake websites that mimic legitimate retailers and those that sell counterfeit products. To ensure safe transactions, always check for secure payment options, such as PayPal or credit card protection.

Payment Safety and Security Measures

Ensuring safe online transactions is vital when purchasing cigarettes. Here are steps you can take:

- Use credit cards instead of debit cards for better fraud protection.

- Look for sites that offer two-factor authentication during checkout.

- Verify that the website has encryption protocols in place (indicated by a padlock in the address bar).

Using secure payment methods and encrypted websites is essential for protecting personal information. Additionally, avoid sharing sensitive data through unsecured channels like email.

Shipping and Delivery Considerations

Shipping policies for online cigarette orders can vary significantly. It’s important to understand the typical policies associated with your chosen vendor. Many reputable retailers provide tracking numbers for shipments, enabling customers to monitor their orders.However, customs regulations can pose potential issues. Different countries and states have specific rules regarding the import of tobacco products, which may affect delivery. It’s advisable to familiarize yourself with these regulations before placing an order.To ensure timely delivery, consider this checklist:

- Confirm shipping options and delivery timelines with the vendor.

- Keep track of your order with the provided tracking number.

- Be aware of potential customs delays if ordering from international vendors.

Customer Reviews and Experiences

Sharing personal experiences when buying cigarettes online can help others navigate the process. It’s beneficial to find and interpret customer reviews about online cigarette vendors to make informed decisions. Look for patterns in feedback, such as recurring issues with delivery times or product quality.Here are testimonials that highlight both positive and negative experiences:

- “I had a great experience with TobaccoOnline.com; my order arrived on time and in perfect condition.”

- “I ordered from a site that seemed legitimate, but the cigarettes were counterfeit with no refund possible.”

Alternatives to Traditional Cigarette Purchases

With the rise of vaping and electronic cigarettes, there are now many alternatives available for those looking to purchase smoking products online. These options often come with different flavors and nicotine levels, appealing to a broader audience. The market for tobacco alternatives is expanding rapidly, providing various products online, from nicotine patches to herbal cigarettes. However, it’s essential to consider health implications associated with these alternatives before making a choice.

- Electronic cigarettes provide a smoking experience without burning tobacco.

- Vaping products often include less harmful ingredients compared to traditional cigarettes.

Understanding the differences can help you make a more informed decision about which product aligns with your health and lifestyle preferences.